With technological advancement comes disruption. Traditional employment opportunities will evolve. Jobs that we think are safe and secure might just be automated out of existence in the near future. New jobs will take their place and the cycle will continue.

At the end of last year, research from Wikijobs revealed that 32% of accounting graduates are very con cerned that robots will soon be filling suitable accounting vacancies, in the form of some kind of automation. Fewer than half of those polled (40%) admitted that they were unsure about the prospects for a career in accountancy, with around two-thirds of respondents willing to consider a career in an alternative industry.

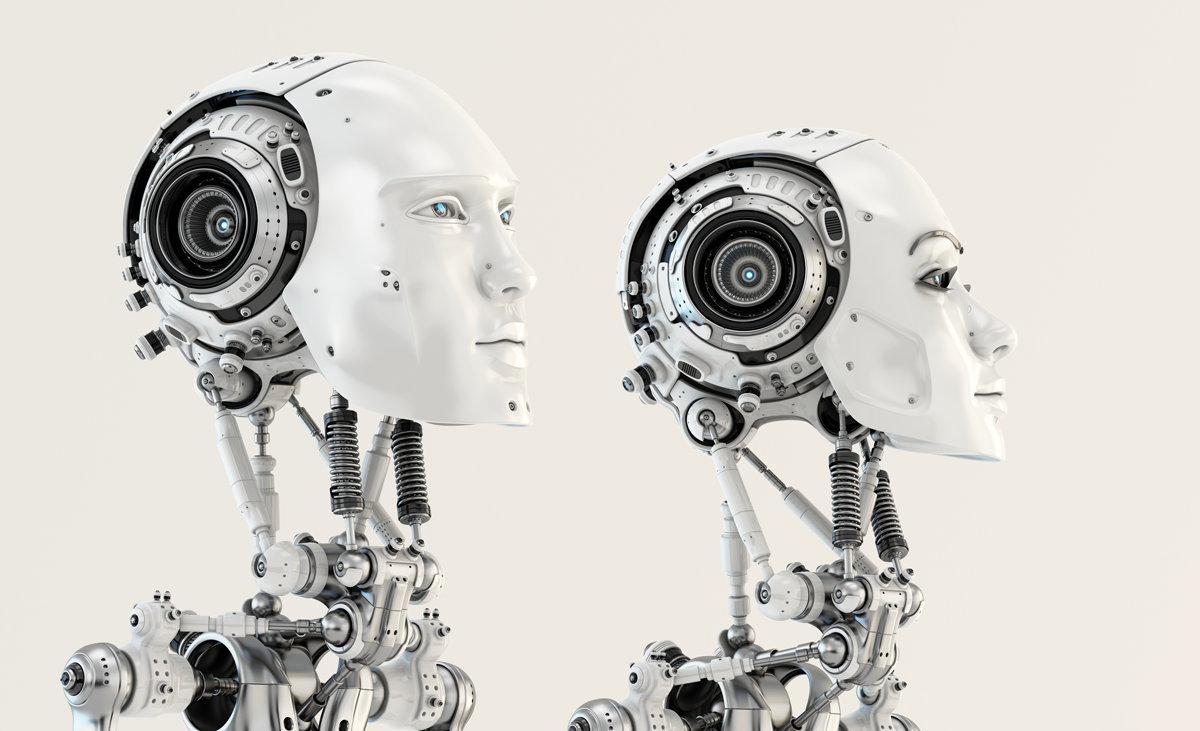

This doesn’t mean there’ll be physical machines replacing people in the office – there will just be an ever-expanding set of tasks that a computer can take care of. And this will cause the creation of new roles that will be of benefit to your business.

We got in touch with several accounting experts, quizzed them about the impact of robots and automation on their roles, and rounded up their responses. The general consensus was that you’ll need to keep an open mind and be prepared to embrace the changing times.

Robots will free you from menial tasks

Automation is already taking care of menial, repetitive tasks, including the scanning and the OCR of documents, says Scot Justice, who used to run a CPA firm but now works in academia. As automation becomes commonplace at work, you should expect more of the same, particularly when it comes to compliance.

For some, like chartered accountant and cloud solutions expert Heather Smith, this will come as a relief. She says she “hates compliance work.”

Fortunately for her, she doesn’t touch it that much, so when automation does take it over, she won’t be greatly affected by the loss of compliance revenue.

Compliance’s loss will also be your gain

While you may lose compliance revenue when accounting automation takes over, you can use this to your advantage.“While some may see it as a threat to the workforce, I see it as a positive opportunity to better serve our clients and heighten performance,”says Roger Philipp, CEO and founder of Roger CPA Review.

You’ll have time to focus on devoting your knowledge and skills to helping clients (legally) shave money off their tax bill and increase investment earnings. “You can’t do this if you’re stuck doing routine tasks,”,says award-winning journalist Kay Bell, who blogs at Don’t Mess With Taxes. “When these tasks can be taken care of automatically, that frees up time for accountants to do what they do best: provide knowledge, strategy and one-on-one counselling to clients for bigger picture financial.”

Robots won’t replicate the human touch

Strong client relationships are built on trust and automation hasn’t yet mastered the crucial skill of human interaction required. “You should never forget that accounting isn’t just a numbers business. At the heart of it, it’s a people business,”

says Philipp. “You’ll never be able to automate the individual, personal analysis that is key to an accountant’s job. Face-to-face advice and explanations to clients can never be replaced,” Bell adds.

You won’t be able to ignore technology altogether

People skills may be vital to attracting clients, but how you provide them with insight and drive their business forward is key to retaining them.

“The future of accountancy is in the value that accountants can add to business. This includes insights into the efficiency of the current business model and more importantly, where the business can go and how to get it there,”

, says Trevor Hartshorne, a practicing accountant and chairman of cloud-based predictive accounting platform Jazoodle.

The software and information systems available today mean that larger volumes of data can be analysed and more insights can be provided. “This can ensure that nothing gets missed, which lowers audit risk. This information can help firms, businesses, and organisations better understand their demographic and zero in on key pain points,” says Philipp. ”

You’ll work with robots, not against them

Technology exists to “play an active supporting role in carrying out traditional accounting functions,” leading to greater accuracy and efficiency, says Prableen Bajpai, director of FinFix Research & Analytics.

As technology advances there’ll be no need to fear it – you should expect to be working alongside automation harmoniously and not competing against it for jobs. “Automation can be tremendously helpful for the accountants and their clients as long as everyone sees it at as what it is: simply a tool to make the job and results better,” says Bell.

Ultimately, if you’re prepared to embrace automation, then you’ll find you have the space to work on providing existing clients with more valuable services and the time to win new clients by taking meetings online.