The key takeaways from Silverfin’s Technology Trends in Accounting 2021 research

What progress have firms made in transforming their business and client services, and how has the pandemic impacted their efforts?

Technology is driving change in client services and working practices. Opening up new opportunities. Here we share views and advice on how to respond.

“Accounting is in the middle of a major shift in purpose, services and business model. Technology is playing a foundational role in supporting firms as they change and look to turn transformation into business opportunity. We call this the era of connected accounting.”

Joris Van Der Gucht, co-founder – Silverfin

Changing client expectations and technology are transforming the traditional services of the accounting profession. Clients want much more than annual compliance reporting from their accountant.

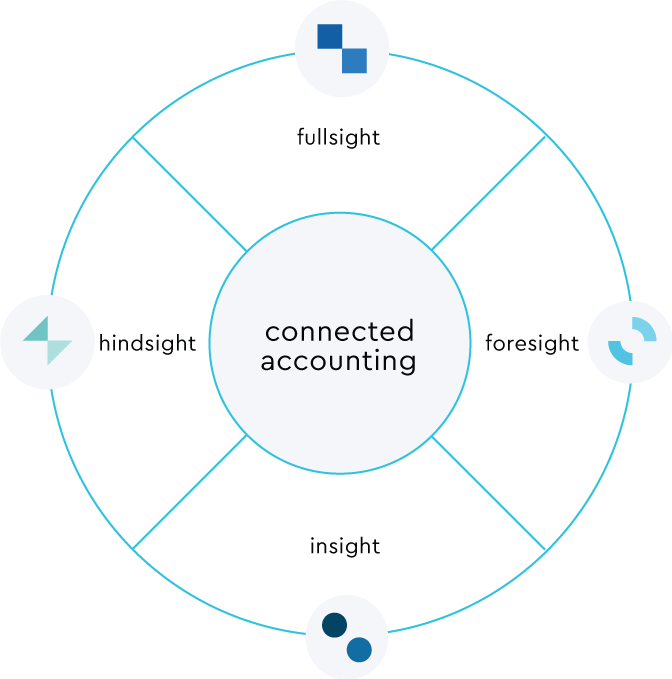

Core accounting services need to be fast and efficient. Advisory needs to be based on reliable data and insights. Automation needs to free up resources to dedicate to clients and the delivery of advisory services. We call this future connected accounting.

What progress have firms made in transforming their business and client services, and how has the pandemic impacted their efforts?

How technology is transforming post-bookkeeping and creating new advisory service revenue.

How to build the accountancy firm of the future and develop new value-added advisory services with technology.

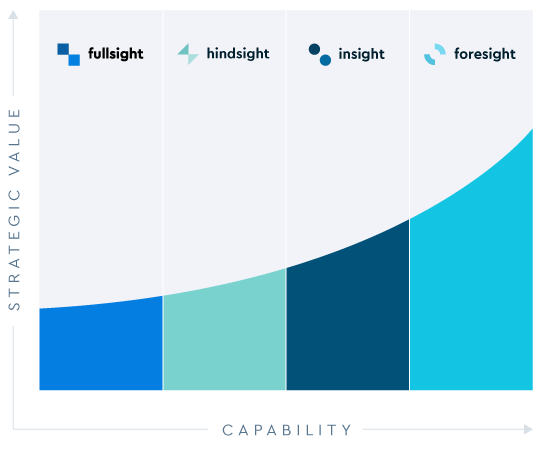

We’ve helped 800+ firms and have identified a common roadmap they follow in their digital strategy for accounting. We call this the connected accounting maturity curve.

Starting out on your technology strategy is hard. Where do you begin? Follow our maturity curve and its 4 stages to understand the key technologies you need and how they work together to ensure success.

Stage 1 is all about data. Create a single and reliable source of truth for all client data.

Stage 2. It’s time to automate your core compliance work. Free up precious resources from manual and repetitive work.

Stage 3 is where you start to develop value-added advisory capabilities built on data. Put yourself in best place to offer powerful and timely advice.

Now you’re ready to move beyond analysing past performance and use data and analytics to predict the future.

Allow us to use your location to deliver personalised experiences, as our products differ from country to country. Your privacy is valued. You can learn more about our privacy policy.