At the recent Accountex conference, Receipt Bank’s director Michael Wood raised an excellent point about how technology’s relentless advance can creep up on us.

“If we think back to the late 90’s, many people will remember the newspaper headlines and articles there were about the internet,” said Wood. “They said we’d be banking online, we’d be doing all our shopping online. These headlines seemed ludicrously over the top – yet here we are 20 years later.”

Wood is right, we live in a world transformed by technology. And the pace of change has only increased and broadened in scope. Whole industries and professions have been disrupted and transformed – accounting is no exception.

So what is the state of play in UK accounting? Where is it going – and what are the accounting challenges it will present?

The rise (and rise) of cloud accounting

Tech’s transformation of accounting is further ahead than most accountants realise. Rod Drury, the founder of Xero, put it brilliantly:

“Every small business, accountant, and bookkeeper now has a supercomputer working for them.”

It’s a bold statement – but also not entirely untrue. The capabilities of accounting software have increased enormously. Not just tax software either. We’ve now started to see the emergence of connected accounting platforms that consolidate and centralise the accountant’s entire workflow.

But none of these applications would work without information. This is where cloud computing has most directly altered the accounting profession. Through the cloud, accounting has seen a user data revolution. Information is changed, sent and manipulated in real time, from anywhere.

And it has dramatically altered the client-accountant relationship. Carpenter Box’s Nathan Keeley noted that cloud increases touch points with the client “by a factor of 10”. That’s because accounting software is creating a real time way of working, requiring a much more attentive accountant.

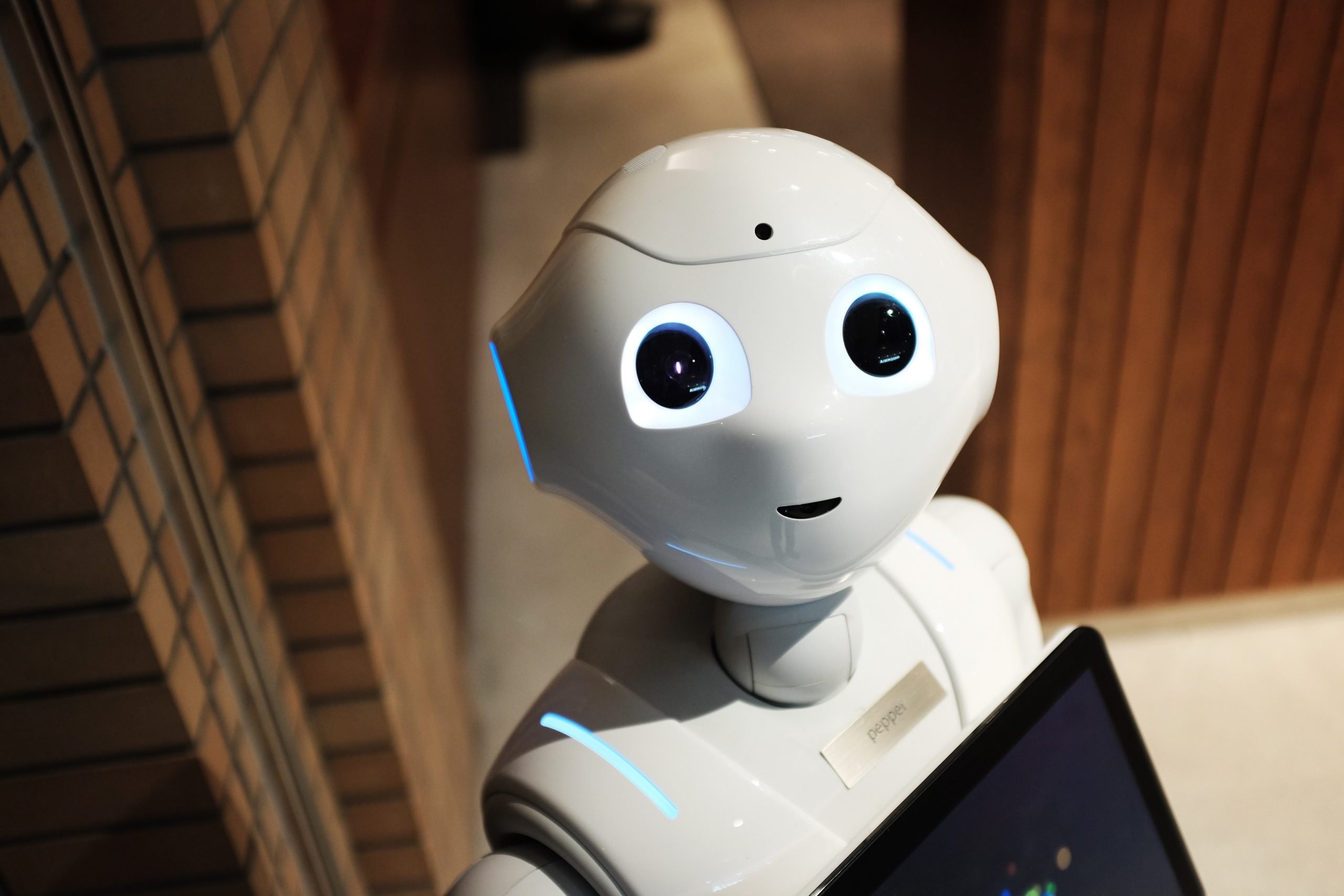

Artificial intelligence

Accounting’s data explosion has fed another – arguably more meaningful – revolution. For many years, artificial intelligence (or, A.I.) was confined to the pages of science fiction novels. But here in 2017, A.I. is quietly transforming accounting.

At its essence, A.I. is the ability of a computer program or a machine to think and learn. The developments in A.I. are spearheaded by the world’s biggest companies – and it has already started to seep into accounting.

Just look at the accounting chatbot Pegg, designed by Sage’s head of artificial intelligence Kriti Sharma. A.I. like this will enable accounting software to become more and more adept at tasks traditionally performed by a human accountant.

With developments like these, the trend of automation in accounting will only increase (probably exponentially).

The accounting challenges of technology

In 2015, NPR set the internet ablaze with its ‘automation calculator’. The calculator looked at specific jobs and estimated the likelihood that the role would be automated. Accounting came in at 93.5% likelihood of automation.

But wait! Don’t throw your hands in the air yet. Unsurprisingly, NPR’s diagnosis was pretty simplistic. As Deloitte’s future of work report points out, technological advances can and have eliminated some jobs. But – and this is crucial – it also creates others.

There’s no reason to suppose that this trend will not continue, says Deloitte:

“We cannot forecast the jobs of the future, but we believe that jobs will continue to be created, enhanced and destroyed much as they have in the last 150 years.”

The accounting challenges that technology presents aren’t necessarily a negative. In fact, it has already inspired the profession to new heights. As accountants’ use of technology increases, so has their ability to analyse, interpret and offer new insights.

Yes, it has never been more challenging to be an accountant. But – for those who get it right – it’s also never been more rewarding.