Many firms struggle with inefficient workflows, outdated systems and the pressure to deliver accurate, timely services to clients. These issues can lead to wasted time, increased errors and missed opportunities for growth with staff suffering from extremely high workloads during busy periods.

By choosing the right platform for your business, you can improve your firm’s efficiency and accuracy and carve out more time for strategic advisory services, giving you a competitive edge and boosting your profitability.

This comparison guide between CCH vs Silverfin aims to address these pain points and evaluate which platform better supports your accounting firm’s needs. It will help you make an informed decision that will enhance your practice’s performance and client satisfaction.

What is CCH?

CCH (Commerce Clearing House), developed by Wolters Kluwer, offers a range of applications designed to manage accounting practices efficiently. Its CCH iFirm platform is part of a much larger ecosystem and is a practice management and compliance tool.

Research suggested that prices start at £540 per year for one user, and each additional user is £140p/a. This doesn’t include pricing for the client portal, which starts at £450 (annually) and an additional £130 per user.

Read more: Reputation at Risk: Why Delaying Your Firm’s Accounting Cloud Migration is a Reputational Timebomb

What is Silverfin?

Silverfin is a cloud-first platform for accounting firms who want to connect and standardise data, automate best practice workflows and leverage AI.

By collecting real-time client data in the cloud and adding automation and AI, Silverfin enables firms to spend less time on “number crunching” and correcting mistakes and more time producing accurate working papers with the time and insights to create strategic conversations with clients.

Unlike CCH, Silverfin works on a per-client file pricing structure. This means that the software grows with your firm and with the flexibility to add modules such as Accounts Production or Corporation Tax as needed.

CCH vs Silverfin: CCH Advantages and Disadvantages

One of CCH’s biggest advantages is its integrated suite. The practice management software suite has a centralised on-premise database, which other CCH products can access. It also has the ability to import data from various bookkeeping systems such as Twinfield, Sage, Xero, Free Agent, Exact, QuickBooks, and CCH Accounts Production.

This unified approach can enhance workflow efficiency; however, it does come with drawbacks. With such deep integration into other CCH products, it may not be ideal for firms that want the software to integrate with apps outside its ecosystem. Another downside is that the data doesn’t always flow seamlessly across the suite, leading to duplicated work or accountants having to rely on manually updating data. The lack of smooth integration means that firms may have to invest additional resources to ensure that data flows correctly between systems, which can be time-consuming and costly.

The platform also supports a wide range of client types, including large and small businesses, sole traders, partnerships, farms, LLPs, and academies. This versatility makes it an attractive option for firms with diverse client portfolios. Moreover, CCH iFirm centralises the review and collaboration processes, enabling teams to work together more efficiently and ensuring all relevant information is accessible in one place.

The cost structure of CCH iFirm can also be a barrier for smaller firms. While the platform offers a range of features, its pricing model may not be flexible enough for firms with limited budgets. Smaller firms may find it challenging to justify the investment, especially given the cost of adding a new user.

While CCH does have cloud features, it’s not a cloud-native solution, which limits its ability to deliver remote team access, making it difficult to access files when not in the office or collaborate in real-time on the same data. Furthermore, CCH does not incorporate AI capabilities, which means users miss out on the efficiencies, innovation, and insights that AI-powered tools can offer.

Read more: The AI Advantage: Why AI and Accountancy Goes Hand in Hand

CCH vs Silverfin: Silverfin Advantages and Disadvantages

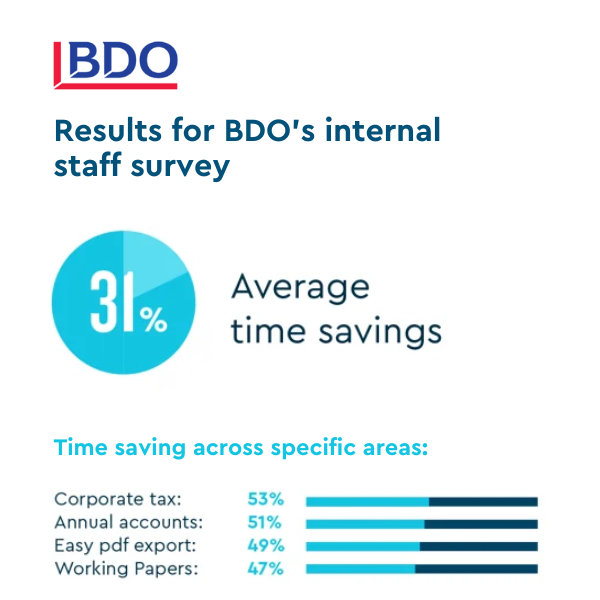

Silverfin was developed and is regularly enhanced by a team of cloud experts, many of whom are former accountants. This background ensures that the platform is both intuitive and tailored to the needs of accounting professionals. Users frequently highlight its ease of use, and the platform boasts a proven track record, having been adopted by the Big 4 and notable UK firms like Deloitte Ireland, BDO and Johnston Carmichael.

One of the standout benefits of Silverfin is the significant time savings it offers. Customers report up to 50% time savings from the second year of usage onwards. This efficiency gain allows accountants to allocate more time to advisory services, which enhances client relationships and provides a competitive edge that helps future-proof their business.

“We believe that accountants of the future will be data-driven advisors above all else.” Lynne Walker, Partner and Head of Business Advisory at Johnston Carmichael

Silverfin also provides an end-to-end solution that covers both compliance workflow automation and analytics for advisory services, reducing the risk of human errors and non-compliance. This comprehensive approach ensures that all aspects of the accounting process are streamlined and integrated.

Unlike other CCH alternatives that require installation and maintenance, Silverfin operates entirely in the cloud. This eliminates the need for cumbersome software installations and ensures that users can always access the latest updates and features through regular maintenance.

The platform supports seamless collaboration by offering pricing tiers based on the number of client files rather than the number of users. This model allows for unlimited users, making it easy for teams to work together without additional costs. Additionally, Silverfin provides the flexibility to choose which modules to use and scale up as needed, accommodating the evolving needs of accounting firms.

Silverfin has many years of experience incorporating AI into its solutions, which enhances data accuracy and aids in training junior staff. For example, Silverfin Assistant can quickly identify anomalies in your data, make recommendations, and spot opportunities for your clients.

However, Silverfin does have some limitations. It may not be suitable for specialist or niche client file types, which could limit its applicability for certain firms. While the platform offers standardised templates, they do not provide the same level of bespoke flexibility that Excel does. Additionally, Silverfin does not include audit functionality, which means firms will need to rely on other tools for this aspect of their work.

Read more: The Hidden Cost of Excel in Accounting: How Spreadsheet Dependence Fuels Burnout

Exploring CCH Alternatives: Which Platform Is Right for Your Firm?

When it comes down to CCH vs Silverfin, the choice ultimately depends on your firm’s specific needs and goals. CCH provides a comprehensive suite with strong integration capabilities (as long as you stay in their ecosystem) but struggles with AI, high costs and a sometimes cumbersome combination of desktop and cloud modules.

Silverfin, with its cloud-native approach and AI-driven automation, offers efficiency gains and proactive AI tools to future-proof your business. While it does offer working paper templates, bespoke flexibility isn’t encouraged and there’s no audit functionality.

For firms prioritising innovation, efficiency, and client advisory services, its user-friendly interface and powerful reporting tools make it an excellent choice for firms looking to enhance efficiency and deliver higher-quality services to clients.

As Brian Murphy, Partner at Deloitte, and Silverfin client puts it, “If you can’t provide your clients with the relevant information and analysis they need to conduct their business operations, they’ll simply go elsewhere.”