Creating corporation tax returns can be a repetitive manual task. Importing, checking and updating data. Multi-screening as you switch between spreadsheets and tools. But it doesn’t have to be that way.

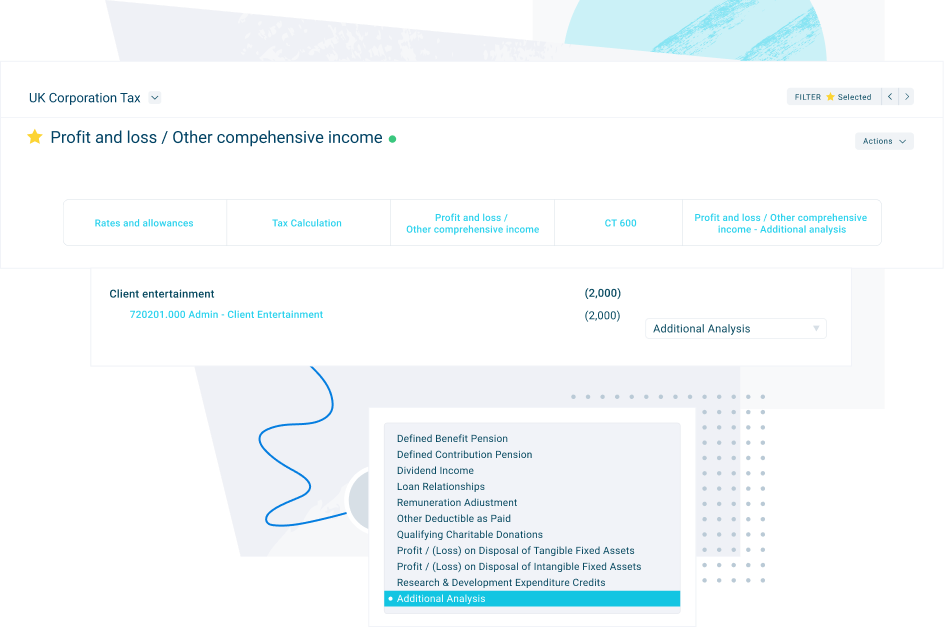

With Silverfin all your data is automatically updated and accessible through the cloud. This information automatically flows into your corporation tax computations as you prepare working papers and statutory accounts too. Always working with the latest data ensures there is no wasted work or version control issues.

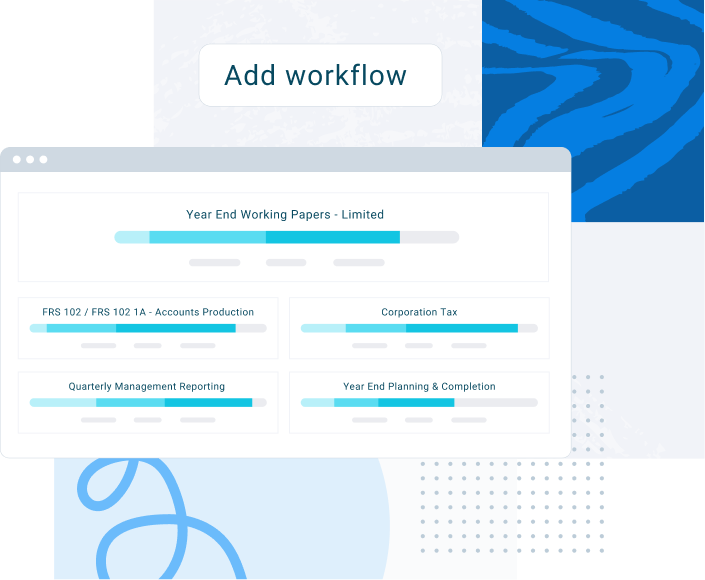

Eliminate errors as everyone, in any office, follows the same best-practice standardised tax workflows. With intuitive schedules, guided navigation and automated reconciliations processes are streamlined and productivity is maximised.

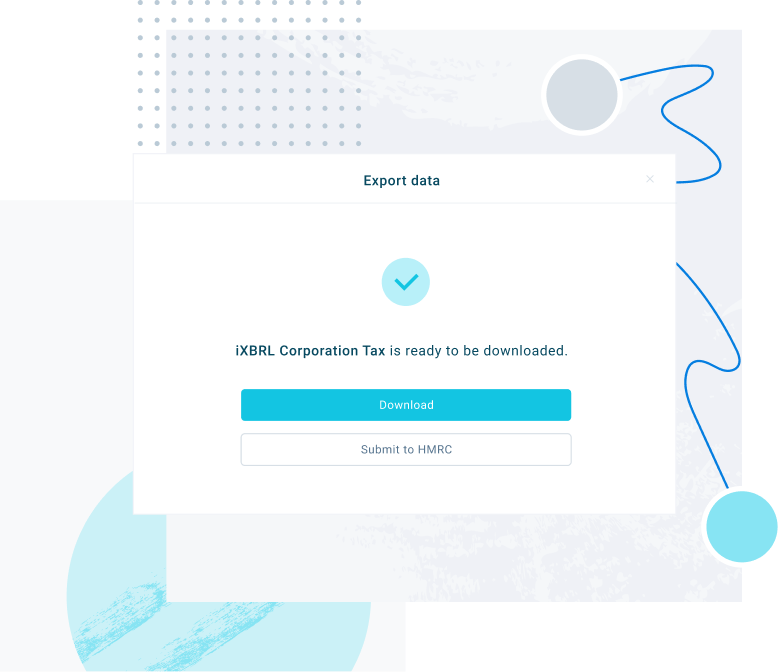

Produce compliant, high-quality CT600 returns, every time. Our built-in data validation ensures you catch any errors. When ready, file your iXBRL tagged return with HMRC with a single click.