Working Papers

Close the books faster with complete confidence

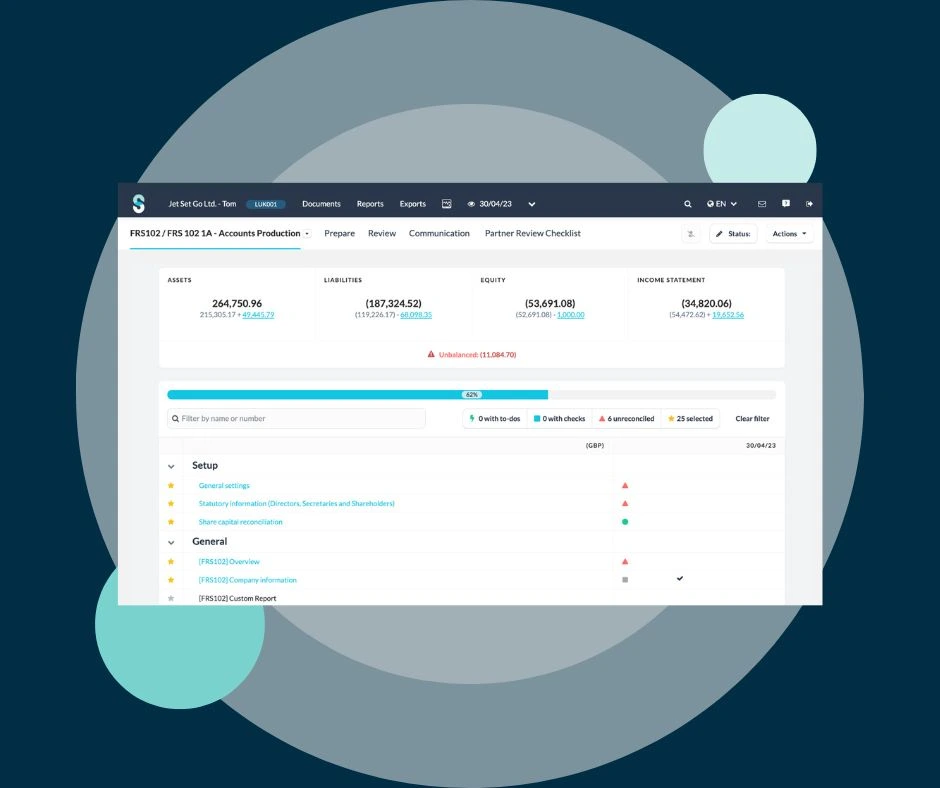

Silverfin Working Papers turns compliance work from a slow, fragmented process into one smooth, connected workflow. Your team can work together in real time, cut out repetitive tasks and get the right data instantly. That means you close the books faster, reduce your risk and delight your clients.

Silverfin is the cloud accountancy platform that makes accountants more successful. It stores historical and live client data, automates compliance and other common accounting workflows, and makes collaboration within the firm and with clients easy. Silverfin takes financial data directly from client systems and hosts it securely in a single structured data hub. No more data silos, no more working with out of date numbers or time consuming manual downloading. Silverfin standardizes this data and uses it in its best practice templates to automate accounting workflows including working papers, accounts production, tax and others making compliance and reporting easy, fast and accurate Silverfin is the cloud platform that makes accountants more successful today

Leading firms work with Silverfin

Work faster, work smarter, reduce the risk

Our cloud platform helps accountancy firms prepare and complete working papers, financial statements, corporation tax and management reports.

Cut out repetitive tasks and data input

Silverfin connects to your accounting software and pulls data straight into your working papers. Standard templates mean less manual typing. Roll-forwards, adjustments and reconciliations happen automatically. Your team can focus on the review and client work instead of spending hours on low-value admin tasks.

Work together without version control issues

Everyone can work on the same file at the same time. You can track changes as they happen, leave review notes and assign tasks directly in the file. Even when your team is spread across different locations, it feels like you’re all in the same room.

Stay compliant and in control

Silverfin is built to meet the latest compliance standards. All client data is stored securely in the cloud. Standardised templates reduce errors and the built-in audit trail shows exactly who did what and when. You can demonstrate compliance with confidence and reduce your firm’s risk.

How do I reduce time spent on year-end working papers?

Many firms still use spreadsheets, disconnected files or outdated tools for working papers. This creates extra work, version control headaches, unnecessary effort and delays in completing reviews. As deadlines approach, teams under pressure scramble to find supporting documents and spend hours reconciling balances. As a result, there ends up being less time to focus on clients or advisory work. Does any of this sound familiar? At Silverfin we understand that client care is at the forefront of your business and we will help you deliver that to the best of your ability by creating time savings throughout the entire process so you have more time for your clients.

Automation and connected workflows make year-end accounts faster and easier

Silverfin brings all your working papers into one platform. Data flows in directly from your accounting systems, creating one source of truth that you can trust. Standard templates cut down on manual input and keep files consistent. Our automation tools help cut out repetitive tasks. Everyone can collaborate and see progress in real time, review work in context and finish jobs without the last minute rush.

Leading firms work with Silverfin

Silverfin’s financial AI delivers improved accuracy and insights, cutting year-end and tax work time by up to 50%. With simple pricing and easy.

of top 100 UK firms are customers

0

%

ambitious firms trust us

0

+

of in market AI enhancements

0

years

“If you can’t provide your clients with the relevant information and analysis they need to conduct their business operations, they’ll simply go elsewhere.”

Brian Murphy

Partner at Deloitte.

Smart features for busy

accounting teams

For busy teams looking for accurate and consistent data, Silverfin includes a wide range of features to support every aspect of client account preparation, including cloud automation, client file standardisation, and financial data analysis

Data Hub

Silverfin’s data hub brings together all your client accounting data securely in the cloud. Structured and ready to work with, it saves hours on client file preparation.

- All the client data you need in one place

- Easy access for anyone in your firm, from anywhere

- Open APIs allow smooth data integrations from client data sources

- World-class data security with enterprise-grade availability

AI Mapping

Our proven AI functionality maps your client files into a standardised Chart of Accounts..

- Automated mapping from any source chart of accounts.

- Instant analysis of incoming data, with alerts for queries.

- Review, amend and confirm mapping from a single dashboard.

- Onboard new client files in a fraction of the time.

Review

Silverfin’s Review feature brings live client data and file communications together — acting as a centralised accounting file review tool to streamline work and ensure accuracy.

- See all client file communications and documentation at a glance and in context

- Prevent duplicate reviews with smart warning pop-ups

- Pick files up wherever and whenever without losing progress

- Fully recorded and auditable

Collaboration

In-context communication and real-time collaboration for accountants ensures your entire team works together efficiently, tracking progress and delighting clients.

- Tag team members and use in-context messaging and to-do’s to smooth file progress

- Keep up to date when you follow topics or clients and use notifications

- Create digital audit trails including all client file communication

- Extend to direct client engagement through the Silverfin Pulse portal

Pricing

At Silverfin, we get that every firm is unique. Our per-file pricing adapts to your client file volumes, with no user limits. Start small and watch your per-file cost drop as you grow.

Firm A

For firms managing fewer client files.

- 125 client files

£100

per file per annum

Firm B

For firms managing higher client file volumes.

- 2000 client files

£60

per file per annum

FAQ

For busy teams looking for accurate and consistent data, Silverfin includes a wide range of features to support every aspect of client account preparation, including cloud automation, client file standardization, and financial data analysis

What sets Silverfin apart as a choice for cloud accounting software for ambitious accounting firms?

Silverfin delivers enhanced accounting for ambitious firms with cloud software with live client files, connected workpapers and AI you can trust. Built by accountants for accountants, we support over 340,000 client files annually for firms including 30 of the UK’s top 100.

How does Silverfin ensure data accuracy and real time access for accountants?

With your live client data stored in the Silverfin Hub, it’s easy for your entire team to access the latest information and streamline core accounting work. With everyone working on the latest client data you avoid wasted work while automation eliminates errors and creates capacity.

What are the time-saving benefits of using Silverfin for year-end preparations and corporation tax submissions?

Fast, accurate, paperless preparation and review of your client accounts with digital workpaper templates connected to your live client file improves accuracy and creates capacity.

Year-end preparations and corporation tax submissions can take 50% less time using automation, roll forward updates, AI data checking and in-context communications.

Can Silverfin help accounting firms enhance their client service and advisory capabilities?

Silverfin can improve the quality and consistency of your firm’s work. For example, prepare and submit MTD-compliant statutory accounts in a fraction of the time with our smart templates, including relevant notes and disclosures. Whether is accounts production or corporation tax, with Silverfin these files are all automatically pre-populated with data from your Working Papers.

Then improve your advisory services and delight clients with portfolio and practice-wide automated data analysis that helps you manage client service delivery, and enable deeper client relationships through data-driven insights.

What pricing model does Silverfin offer and how does it benefit accounting firms?

Silverfin can improve the quality and consistency of your firm’s work. For example, prepare and submit MTD-compliant statutory accounts in a fraction of the time with our smart templates, including relevant notes and disclosures. Whether is accounts production or corporation tax, with Silverfin these files are all automatically pre-populated with data from your Working Papers.

Then improve your advisory services and delight clients with portfolio and practice-wide automated data analysis that helps you manage client service delivery, and enable deeper client relationships through data-driven insights.